eCheck Payment Processing Increase Online Revenue

eCheck payment option offers great security to your transaction. In the United States, eCheck payment processing offers incredible ways of processing the payment. Thus, it is seen as a faster way to process your payment and is considered to be a reliable way for merchants.

Not all consumers are interested in credit cards and several merchants offer a secure option to credit card solution. eCheck Payment Processing is a flexible mode of payment. In electronic checks also mentioned as an e-check is a type of payment made by means of the internet. It is designed in the same way as a traditional paper check. The check is an electronic presentation. This was the principal procedure of Internet-based payment employed by the United States Treasury for making huge online payments.

Not all consumers are interested in credit cards and several merchants offer a secure option to credit card solution. eCheck Payment Processing is a flexible mode of payment. In electronic checks also mentioned as an e-check is a type of payment made by means of the internet. It is designed in the same way as a traditional paper check. The check is an electronic presentation. This was the principal procedure of Internet-based payment employed by the United States Treasury for making huge online payments.

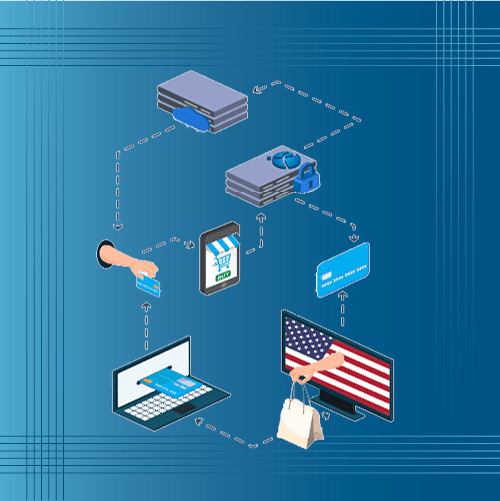

How electronic check functions?

An electronic check is regarded as a part of the greater electronic banking area and is supposed to be Electronic Fund Transfers. This not only refers to electronic checks however other computerized banking tasks like debit card transactions, check depositing traits, etc. Here the transaction needs internet and networking tools to access the related account info to go for requested functions. Electronic checks can be employed to make an amount paid for any transaction as similar to paper checks.

eCheck as an instant payment to customers

eCheck Payment Processing is an instant payment that you can avail with no hassles. You can go for this processing if you are looking for solutions. With eChecks, you can move your business to height without any trouble. Thus, you avail huge transaction process with no delay.

Offshore payment gateway with eCheck Payment Processing

eCheck Payment Processing with an Offshore payment gateway offers a merchant account solution for your business. Offshore payment gateway aids the merchants in availing a merchant account. With an offshore payment gateway, you can avail an awesome solution for your business. Offshore solutions are easy to avail as compared to domestic payment gateway solutions. If you are looking for offshore solutions, you can avail with the aid of a merchant account processor. Offshore solutions have less rigid rules and can be availed within a short time as compared to domestic payment gateway.

High-risk solutions for protecting your business

High-risk solution with eCheck Payment Processing offers a solution to secure your business. This can be done through 2d and 3d solutions that secure your business transaction. You can make your payment safe while receiving payment from customers. Your payment gateway is integrated with 2d and 3d solutions. You can avert chargebacks and scams as far as possible. With high-risk solutions, you can effectively move your business ahead.

Look for eMerchant Pro for a facility

If you are looking for eCheck Payment Processing then eMerchant Pro offers the accurate facility. In this case, look for eMerchant Pro services and acquire a merchant account. eMerchant Pro is recognized for merchant account services and offers diverse solutions at an affordable rate. Once you come in contact with them through an online application, you are able to get guidance from the eMerchant Pro experts. The experts will ask for relevant documents related to your business and after viewing your documents will forward to the acquiring bank. The acquiring bank after viewing all your credentials will finally agree for a merchant account.